In the tradition of tax years past, it’s the season to talk about charitable contributions!

In the tradition of tax years past, it’s the season to talk about charitable contributions!

Charitable donations are an excellent way to reduce your tax burden for the year, all while doing something for the greater good. Here’s the catch there are only 4 days left to give this year. But as with everything in tax law, there are procedures and rules that need to be followed. Here are 12 tips for making sure that you get the best bang for your holiday bucks:

You must itemize in order to claim a charitable deduction. You report itemized deductions on Schedule A on your federal form 1040 using lines 16-19:

Only donations to qualified charitable organizations are deductible. If you’re not sure whether an organization is qualified, ask to see their letter from the IRS (many organizations will actually post their letters on their web site). If that isn’t possible, you can search directly online using IRS Publication 78. Keep in mind that churches, synagogues, temples and mosques are considered de factocharitable organizations and are eligible to receive deductible donations even if they’re not on the list (some exceptions apply so be sure and ask if you’re not sure). I would also suggest that you check out a potential charitable organization before you make a donation: Charity Navigator is a great site to gather information.

Cash deductions, regardless of the amount, must be substantiated by a bank record (such as a canceled check or credit card receipt, clearly annotated with the name of the charity) or in writing from the organization. The writing must include the date, the amount and the organization that received the donation.

Cash deductions that are not substantiated, such as a cash donation without a receipt, or donations made directly to an individual rather than a qualified charitable organization will be disallowed. That includes paying for someone else’s Christmas presents or lending a helping hand like these donors did at K-Marts around the country (read the story, tissue in hand). This doesn’t mean that you shouldn’t do these random acts of kindness – in fact, I would argue just the opposite – but it does mean that you can’t claim the deduction on your tax return. If you have money taken out of your paycheck for charity, be sure to keep a pay stub, a form W-2 or other document furnished by your employer showing the total amount withheld for charity, along with the pledge card showing the name of the charity.

For 2012 only (unless Congress extends it and, er, I wouldn’t count on it), an IRA owner who has reached the age of 70½ or older can make a direct transfer of up to $100,000 per year to an eligible charity, tax free. This means that amounts directly transferred to the charity from an IRA are counted in determining whether the owner has met the IRA’s required minimum distribution (RMB) but will not be considered a taxable withdrawal. Nice, right? Some restrictions apply including the fact that distributions from employer-sponsored retirement plans, including SIMPLE IRAs and simplified employee pension (SEP) plans, are not eligible.

For donations of non-cash items, the rule is that you can generally take a deduction for the fair market value of the items – what the item would sell for in its current condition. Be specific when you document your donation, noting the description and condition of the items.

There’s an exception to tip #7: if you make non-cash deductions of clothing and household items, they are only deductible if in good used condition or better. This makes sense, of course, because if your old Levi’s are so bad that you wouldn’t want to wear them, why would you think someone else would want to? However, if the item is valued over $500 but not in “good” condition, you may still take the deduction if you have an appraisal for the item.

The rules for the donation of a car, truck, other motor vehicle, boat or airplane are a little different. Rather than use the fair market value of the donation, you are generally limited to the gross proceeds from its sale if the value of the item is more than $500. You will need to get a form 1098-C, or a similar statement, from the charitable organization and attach it to your tax return. For more information about donating a car, check out this handy guide from Kars 4 Kids.

If the amount of all of your non-cash contributions is over $500, you must also submit a form 8283, Noncash Charitable Contributions, (downloads as a pdf) with your tax return.

Special rules apply to appreciated goods like stock or jewelry, or hard to value items such as artwork. If you are planning on making these kinds of donations, check with your tax professional for more information.

Contributions are deductible in the year made so be sure and get those gifts in by December 31. And yes, that means that credit card charges made before the end of the year are deductible even if the credit card bill isn’t paid until the next year. Similarly, checks which are written and mailed by the end of the year will be deductible for this year even if they aren’t cashed until 2012.

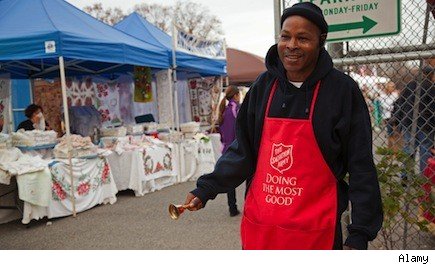

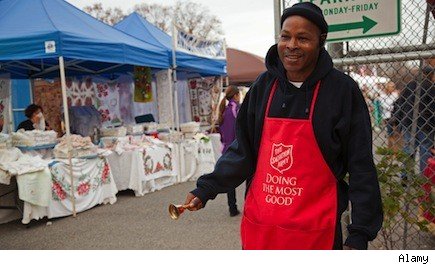

As the holiday season comes to an end, I hope that you’ll remember to be charitable. No matter what your individual situation, you can likely do something good from donating cash to a used prom dress. Even if you can’t claim a donation, you can take a hour out of your week to be a bell-ringer for the Salvation Army, deliver meals to the homeless or shovel some snow for a shut-in (although remember that you cannot deduct the value of your services). Never underestimate the difference that one person can make.

Source @TaxGirl

I love your blog.. very nice colors & theme.

Did you create this website yourself or did you hire someone to do it for you?

Plz respond as I’m looking to construct my own blog and would like to find out where u got this from. appreciate it